Key Responsibilities

Fractional CFOs are responsible for a myriad of financial tasks, including but not limited to:

- Strategic Planning: Developing and implementing long-term financial strategies that align with business goals. This involves a deep understanding of business operations, competitive environment, and growth potential, ensuring that financial plans are both realistic and geared towards sustainable success.

- Financial Forecasting: Creating financial models to predict future revenue, expenses, and cash flow. Fractional CFOs use historical data and market trends to build these forecasts, which are essential for managing expectations and planning future initiatives.

- Cash Flow Management: Ensuring the business has enough liquidity to meet its obligations and invest in growth opportunities. This includes monitoring accounts receivable and payable, managing credit lines, and optimizing company cash reserves.

- Financial Analysis: Evaluating the company’s financial health and providing insights to improve profitability. Fractional CFOs conduct detailed analyses on cost structures, pricing models, and operational efficiencies to maximize profit margins.

- Budgeting: Preparing and managing budgets to ensure financial resources are allocated effectively. This involves establishing spending limits for various departments and ensuring that each division’s expenditures align with overall company goals.

- Fundraising: Assisting in raising capital through equity or debt financing, including venture capital and private equity. Fractional CFOs play a pivotal role in crafting compelling pitches to investors and negotiating favorable terms.

- Mergers & Acquisitions: Providing guidance and oversight during business transactions and integrations. They help in assessing potential deals, valuing targets accurately, and ensuring seamless integration post-acquisition.

- Financial Reporting: Preparing financial statements and reports for stakeholders, including investors and board members. This entails accurate preparation of balance sheets, income statements, and cash flow statements while ensuring compliance with relevant accounting standards.

Why Hire a Fractional CFO?

Hiring a fractional CFO offers several advantages for businesses. These benefits include:

- Cost-Effectiveness: Access to top-tier financial expertise without the financial burden of a full-time salary and benefits. Fractional CFOs deliver focused services tailored to specific business needs, thus optimizing financial resources.

- Flexibility: Ability to scale services up or down based on business needs, making it an ideal solution for companies experiencing rapid growth or seasonal fluctuations. This flexible engagement ensures that the business gets the right level of support as its requirements evolve.

- Diverse Experience: Fractional CFOs often work with multiple industries, providing a broad perspective and diverse skill set. Their experience across different market scenarios allows them to bring innovative strategies that catalyze company growth.

- Focused Expertise: They can be brought in for specific projects or challenges, such as preparing for a capital raise or improving cash flow management. Their specialized knowledge can fill gaps in existing management teams, driving more informed and resourceful decision-making.

- Mentorship and Training: They can mentor internal finance teams, improving overall financial acumen within the organization. This aspect not only enhances current capabilities but also builds a more robust financial management structure for the future.

How to Find a Fractional CFO for Hire

Finding the right fractional CFO can greatly enhance your company’s financial management. Here are methods to locate and hire a qualified fractional CFO:

1 . Professional Referrals

Reach out to your network, including CPA firms, attorneys, and business consultants, for recommendations. These professionals often have connections with experienced fractional CFOs. By tapping into their networks, businesses can find trusted candidates who have already demonstrated success in similar roles.

2 . Fractional CFO Firms

Consider hiring through firms that specialize in providing fractional CFO services. These firms conduct thorough vetting processes to ensure their CFOs meet high standards of expertise and professionalism. Firms often have a broad network and extensive resources to find the perfect fit quickly and efficiently.

3 . Online Platforms

Leverage online platforms like LinkedIn, Upwork, or specialized financial consulting networks to find fractional CFO candidates. These platforms offer filters to narrow down choices based on industry, expertise, and client feedback, allowing you to evaluate potential hires based on previous client reviews and ratings.

4 . Industry Events and Networking

Attend industry events, seminars, and networking groups where financial professionals gather. This can be an excellent opportunity to meet potential candidates in person and assess their expertise and cultural fit. Face-to-face interaction often provides a clearer sense of a candidate’s capability and approach.

5 . Recruitment Agencies

Engage recruitment agencies that specialize in financial roles. These agencies have access to a wide pool of candidates and can assist in finding a fractional CFO with the specific skills and experience your business requires. Recruitment specialists can handle the initial stages of screening and negotiation, saving you time and effort.

Fractional CFO Services and Their Benefits

Fractional CFO services are tailor-fitted to meet the unique needs of each business, offering flexibility and depth of expertise. The key benefits of these services include:

- Strategic Financial Planning: Aligning financial strategies with business objectives to drive growth and sustainability. These services help in identifying financial goals and developing actionable strategies to achieve them.

- Improved Financial Oversight: Providing expert analysis and oversight of financial operations to ensure accuracy and compliance. A trained eye helps in maintaining statutory compliance and reducing financial risks.

- Enhanced Decision-Making: Supplying data-driven insights that support informed business decisions. Leveraging data analytics, fractional CFOs can highlight areas of improvement and potential opportunities in real-time.

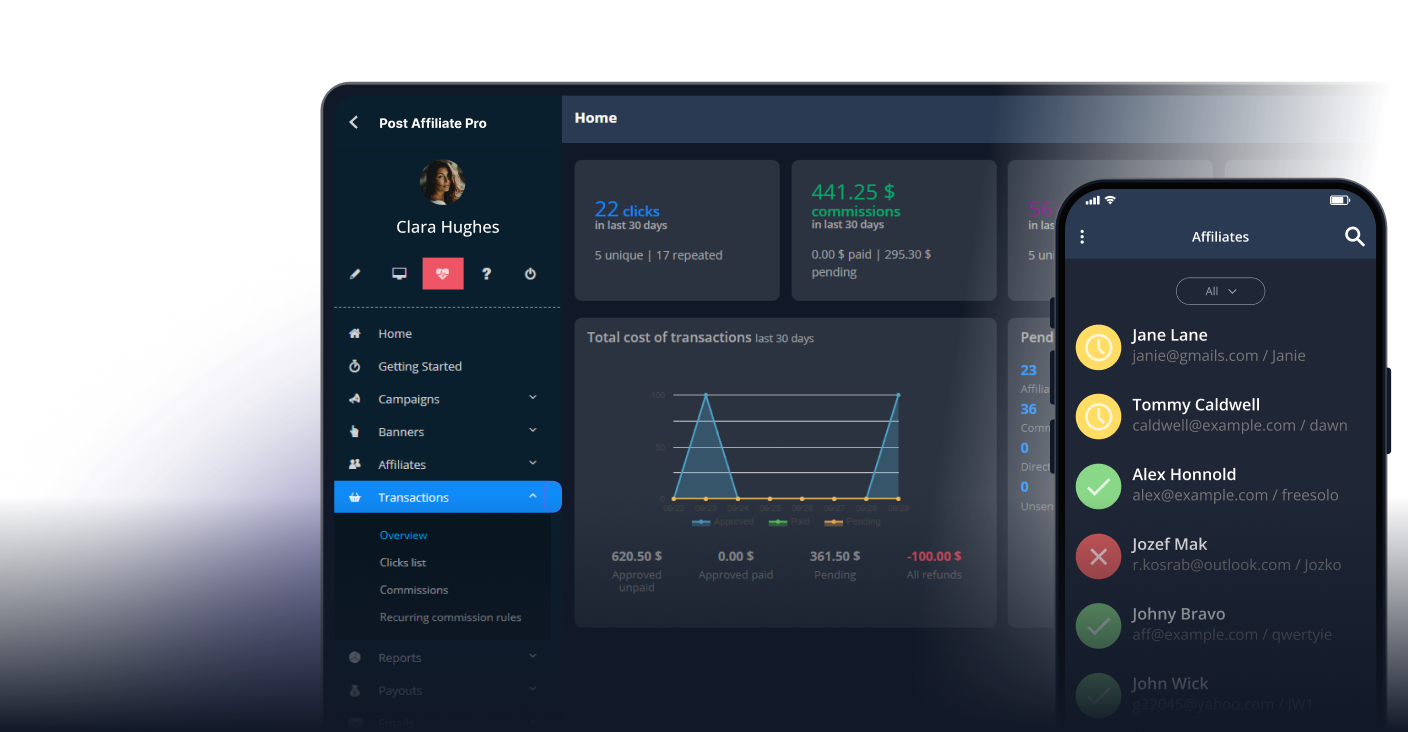

- Access to Tools and Resources: Utilizing advanced financial tools and software to streamline processes and improve efficiency. By investing in and utilizing the latest technology, fractional CFOs can enhance a company’s financial infrastructure and processes.

- Scalability: Ability to adjust the level of service as the company grows or faces new challenges. This adaptability ensures that, regardless of changing business needs, the company continues to receive appropriate financial guidance.

What to Consider When Hiring a Fractional CFO

When hiring a fractional CFO, the following factors are important to ensure you select the right candidate for your business:

- Experience and Expertise: Look for candidates with a proven track record in your industry and with the specific financial challenges you face. An experienced CFO brings insights that only years of industry-specific work can provide.

- Cultural Fit: Ensure the CFO’s working style aligns with your company’s culture and values. This alignment helps in integration and ensures smooth collaboration with existing teams.

- Communication Skills: Effective communication is key for translating complex financial data into actionable insights for non-financial stakeholders. A CFO adept at communicating complex concepts ensures all team members understand financial implications.

- Availability and Commitment: Confirm the candidate’s availability meets your company’s needs and that they can commit to the required hours or projects. Consistent availability guarantees continuity in financial oversight and management.

- References and Reviews: Check references and seek feedback from previous clients to gauge the CFO’s reliability and effectiveness. This due diligence helps in understanding the candidate’s strengths and potential areas of concern.

The Role of a Fractional CFO in Affiliate Marketing

In the context of affiliate marketing, a fractional CFO can optimize financial operations and strategy. They can assist with:

- Budget Allocation: Ensuring marketing budgets are effectively distributed across channels to maximize ROI. Accurate budget planning helps in achieving more with available resources.

- Performance Metrics: Developing KPIs to measure the success of affiliate programs and campaigns. By setting clear benchmarks, businesses can accurately gauge campaign effectiveness.

- Revenue Optimization: Analyzing revenue streams and identifying opportunities for growth and diversification. A strategic focus on revenue channels ensures stable cash flow and profitability.

- Risk Management: Identifying financial risks associated with affiliate partnerships and implementing strategies to mitigate them. This preparation prevents potential financial losses and safeguards business interests.

- Strategic Partnerships: Advising on the financial implications of potential partnerships and collaborations within the affiliate marketing ecosystem. Proper financial assessment ensures partnerships are beneficial in the long run.