What is Lifetime Value (LTV)?

Lifetime Value (LTV), also known as Customer Lifetime Value (CLV), is a pivotal metric that estimates the total revenue a business can expect to generate from a customer account throughout the entirety of their relationship. This metric is crucial for businesses as it helps in understanding the long-term value of customers, guiding decisions in marketing, sales, and overall business strategy. It helps businesses allocate resources efficiently, optimize marketing spend, and maximize profitability by focusing on customer retention and acquisition strategies.

LTV is not just a measure of past success but a predictive metric that provides insights into the future performance of the customer relationship. Understanding LTV enables businesses to identify key customer segments that contribute the most to the bottom line, thus allowing for more targeted marketing efforts and customer service enhancements. This forward-looking approach helps businesses in crafting long-term strategies that aim not just at acquiring customers but retaining them and increasing their overall value to the company.

Importance of LTV in Business

- Enhanced Customer Loyalty and Retention : Understanding LTV allows businesses to focus on nurturing long-lasting relationships with high-value customers, thereby boosting customer loyalty and retention. This knowledge helps in tailoring marketing and customer service efforts to retain customers for longer periods, which is more cost-effective than acquiring new customers .Retention strategies may include personalized experiences, loyalty programs, and proactive customer service approaches. By leveraging data analytics, businesses can predict customer behavior and intervene before churn, thus maintaining a strong customer base.

- Optimized Customer Acquisition Costs (CAC) : LTV provides insights into how much a business can afford to spend on acquiring a new customer , ensuring that the acquisition costs are justified by the long-term revenue potential. A good practice is to maintain a favorable LTV to CAC ratio, typically around 4:1, to ensure sustainable profitability.This ratio ensures that the cost of acquiring a customer is significantly lower than the revenue that customer will bring over their lifetime. Businesses can use this metric to adjust their marketing budgets and strategies, focusing on channels and tactics that yield the highest LTV.

- Improved Financial Planning and Forecasting : By projecting the future value of customers, businesses can make informed financial decisions and better allocate budgets and resources. LTV aids in revenue forecasting and strategic planning, helping businesses to anticipate cash flows and investment returns.This predictive capability allows businesses to make strategic investments in product development, customer service enhancements, and market expansion initiatives, aligning financial planning with long-term business objectives.

- Refined Marketing Strategies : LTV helps businesses identify their most profitable customer segments, allowing them to tailor marketing strategies to target similar high-value customers. This refined focus can lead to more effective marketing campaigns and higher conversion rates.By understanding the characteristics and behaviors of high-LTV customers, businesses can create targeted marketing campaigns that appeal to similar prospects, thus increasing the efficiency and effectiveness of their marketing efforts.

- Reduction in Customer Churn : By analyzing LTV, businesses can detect early signs of customer attrition and implement strategies to prevent churn. This might include enhancing customer service, offering loyalty programs, or personalizing customer experiences to encourage continued engagement.Reducing churn not only helps in maintaining a stable revenue stream but also enhances the overall brand reputation, as satisfied customers are more likely to refer others and act as brand advocates.

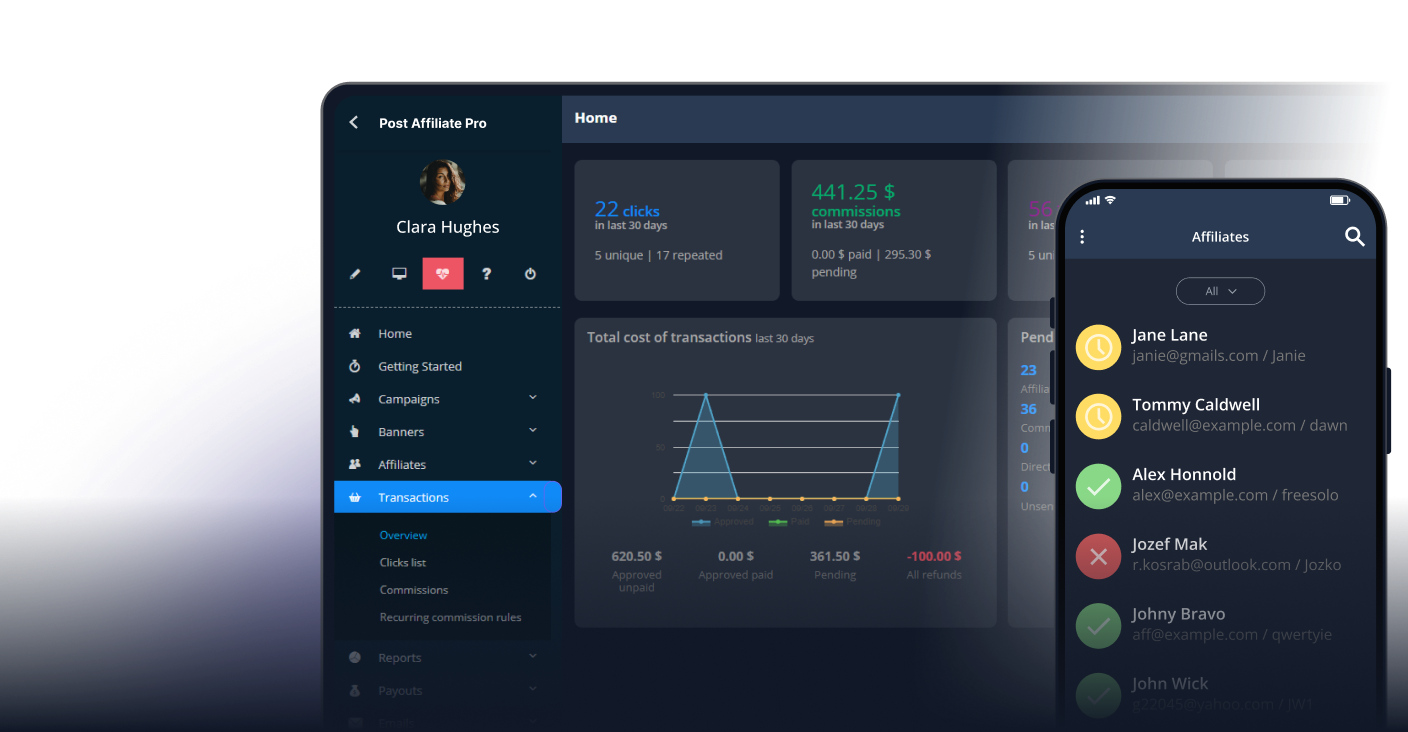

Connection with Affiliate Marketing

In the context of affiliate marketing , LTV is a significant metric that influences how affiliates are recruited and managed. Understanding the lifetime value of customers brought in by affiliates can guide commission structures and partnership strategies. High-LTV customers acquired through affiliates can justify higher commission rates, as these customers contribute more significantly to the business’s bottom line over time.

How LTV Benefits Affiliate Marketing:

- Tailored Commission Structures : Businesses can design commission structures that reward affiliates for bringing in high-LTV customers, encouraging them to focus on quality over quantity.By incentivizing affiliates to target quality leads, businesses can ensure that marketing efforts are aligned with long-term profitability goals.

- Long-Term Affiliate Relationships : By understanding LTV, businesses can foster long-term relationships with affiliates, reducing turnover and ensuring consistent and effective promotion of the brand .Building strong partnerships with affiliates can lead to more consistent marketing efforts and better brand representation in the market.

- Cost-Effective Marketing : Affiliates can provide innovative marketing ideas at lower costs, leveraging their insights into consumer trends to attract high-value customers and enhance LTV.Affiliates often have unique insights into niche markets and consumer behavior, which can be invaluable in crafting targeted and effective marketing campaigns.

How to Calculate Lifetime Value

LTV can be calculated using various formulas, depending on the business model and available data. A common LTV formula is:

LTV = Average Purchase Value * Purchase Frequency * Customer Lifespan

Components of LTV Calculation:

- Average Purchase Value : The average amount a customer spends per transaction.

- Purchase Frequency : How often a customer makes a purchase over a set period.

- Customer Lifespan : The average duration a customer continues purchasing from the business.

For subscription-based models, LTV can also be calculated by dividing the average revenue per user (ARPU) by the churn rate:

LTV = ARPU / Churn Rate

This calculation provides a straightforward way to estimate the value of a customer in subscription businesses, where recurring revenue models are prevalent.

Challenges in Calculating LTV

- Data Accuracy : Reliable data is crucial for accurate LTV calculations. Inaccurate data can lead to flawed forecasts and misguided business decisions.Ensuring data integrity involves regular data audits, validation processes, and leveraging advanced analytics tools to gather accurate insights.

- Dynamic Customer Behavior : As customer preferences and behaviors evolve, LTV calculations must be regularly updated to reflect these changes.Businesses must stay agile and continuously monitor market trends and customer feedback to adjust their strategies and LTV calculations accordingly.

- Segment Variability : Different customer segments may have varying LTVs, necessitating tailored strategies for each segment.By conducting detailed segmentation analysis, businesses can identify unique characteristics and preferences of each segment, allowing for more personalized approaches.

Enhancing Lifetime Value

- Close Feedback Loops: Actively seek and address customer feedback to improve satisfaction and reduce churn.By listening to customer feedback and making necessary improvements, businesses can demonstrate their commitment to customer satisfaction and foster loyalty.

- Invest in Customer Experience: Enhance every touchpoint in the customer journey to boost satisfaction and retention, thereby increasing LTV.A seamless and delightful customer experience across all interactions can significantly enhance customer satisfaction and loyalty.

- Implement Loyalty Programs: Encourage repeat purchases and long-term engagement through rewards and incentives.Well-designed loyalty programs that offer meaningful rewards can increase customer retention and encourage frequent interactions with the brand.

- Personalized Marketing: Use customer data to deliver tailored marketing messages that resonate with individual preferences and needs.Personalization not only improves the relevance of marketing messages but also builds a stronger emotional connection with customers.

- Omnichannel Support: Provide seamless support across all customer interaction channels to ensure a consistent and positive experience.An integrated approach to customer support , encompassing various channels, ensures that customers receive timely and effective assistance, enhancing satisfaction and LTV.

Understanding Customer Lifetime Value (CLV) in Affiliate Marketing

Introduction to Customer Lifetime Value

Customer Lifetime Value (CLV) is a critical metric in measuring the average monetary value a customer contributes to your business throughout their entire relationship with you. Understanding CLV is crucial for making informed decisions about customer acquisition strategies, especially in the realm of affiliate marketing .

Calculating CLV: The Core Formula

The formula for calculating CLV involves three key variables: average order value, average purchase frequency, and average customer lifespan. These components help determine how much a customer is worth on average, thus guiding how much you can invest in acquiring new customers through affiliate channels .

CLV Formula Breakdown

- Average Order Value : This is the typical amount a customer spends per transaction.

- Average Purchase Frequency : This indicates how often a customer makes a purchase over a set period.

- Average Customer Lifespan : This reflects the duration a customer continues to purchase from your business.

By multiplying these three values, you get the CLV, which is essential for setting benchmarks in your affiliate marketing strategies . For instance, if your CLV is significantly higher than your customer acquisition costs, it indicates a healthy margin for investing in affiliate partnerships .

Practical Examples of CLV in Action

Consider a marketing tool that costs $50 per month, with an average customer lifespan of 16 months. Here, the CLV would be $800 (50 x 1 x 16). This example illustrates how knowing your CLV allows you to assess whether your affiliate marketing efforts are cost-effective.

Another scenario involves a running shoe company where customers buy two pairs of shoes annually, spending $128 per order over two years. The CLV here would be $512, highlighting the potential revenue per customer and informing your affiliate marketing strategies to target similar customers.

Challenges in Determining CLV

One common challenge in calculating CLV is the lack of sufficient data, especially for newer businesses. Without historical data on customer behavior, predicting the average lifespan and purchase frequency becomes difficult. In such cases, businesses can initially focus on unique customer value over shorter periods to inform their affiliate marketing decisions.

Maximizing CLV Through Affiliate Marketing

By understanding and leveraging CLV, businesses can optimize their affiliate marketing strategies, ensuring that their partnerships are not only profitable but also sustainable. Tailoring affiliate programs to attract and retain high-value customers becomes more feasible when you have a clear understanding of your CLV.