What is a payment threshold?

IIn the realm of affiliate marketing

, a payment threshold is defined as the minimum amount of commission an affiliate must accumulate in their account before they are eligible to receive a payout from the affiliate program. This threshold is a crucial aspect of affiliate agreements

and varies across different affiliate networks

and programs. Essentially, the payment threshold acts as a benchmark to determine when an affiliate’s earnings are substantial enough to warrant a transfer of funds.

Launch your affiliate program today

Set up advanced tracking in minutes. No credit card required.

Importance of Payment Thresholds in Affiliate Marketing

Payment thresholds serve multiple purposes within the affiliate marketing ecosystem:

- Efficiency in Transactions : By setting a minimum payout limit, affiliate programs

reduce the frequency of transactions, thus minimizing administrative costs and processing fees associated with frequent, smaller payouts. This efficiency can be crucial in maintaining streamlined operations and reducing unnecessary financial outlays.

- Commitment and Performance : A well-calibrated payment threshold can incentivize affiliates to engage more actively and work towards reaching the threshold. It encourages affiliates to drive more sales and traffic to the merchant’s site, aligning the interests of both parties. As a motivational tool, it pushes affiliates to optimize their strategies and enhance their marketing efforts.

- Cash Flow Management : For companies, maintaining a payment threshold is a strategic tool for managing cash flow. It ensures that payouts are made only once a significant amount of commission is due, allowing the company to better predict and manage its financial obligations. This strategy helps in balancing the books and ensuring that the company’s financial health is not compromised by frequent small payouts.

How Payment Thresholds Work

Payment thresholds are typically stipulated in the affiliate program

’s terms and conditions. Here’s how they generally operate:

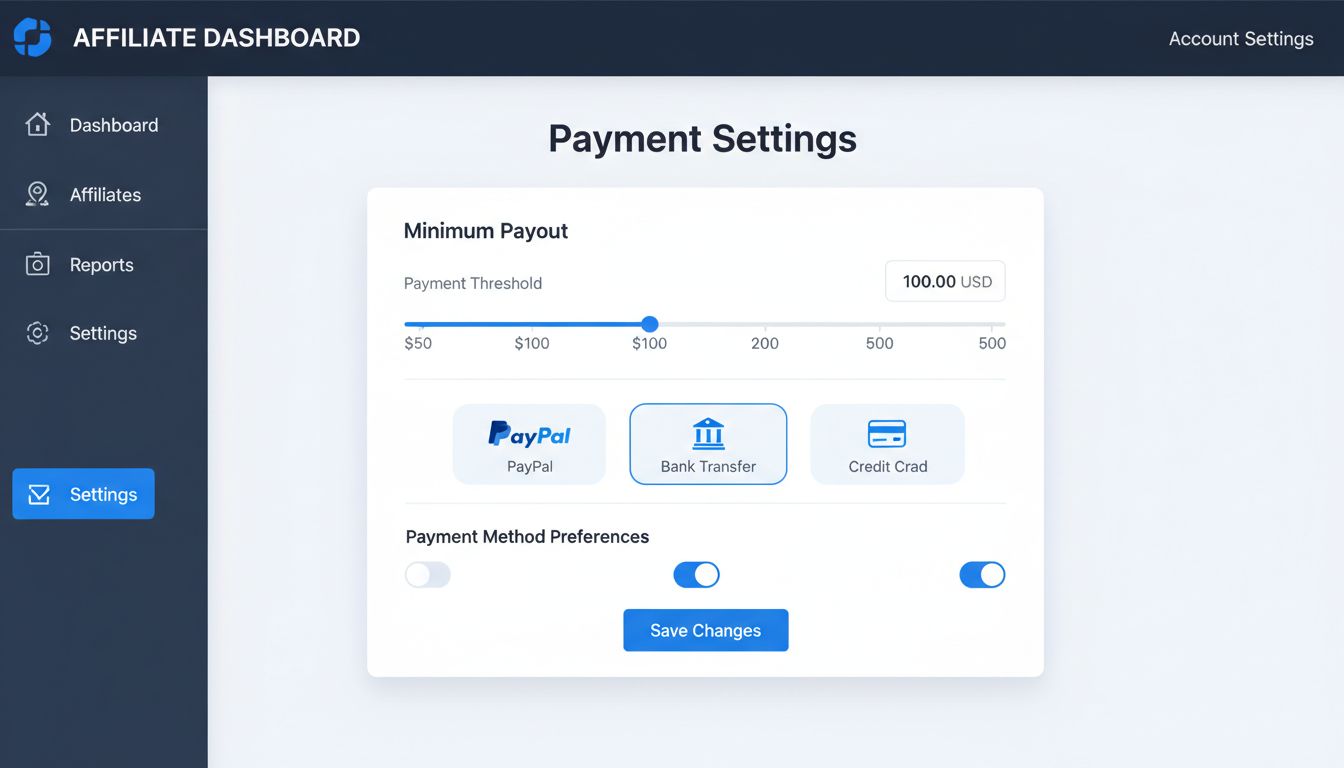

- Setting the Threshold : The merchant or the affiliate network

sets a specific dollar amount as the payment threshold. Common threshold amounts can range from $10 to $100 or even higher, depending on the affiliate program’s policies. This setting is critical and often reflects the program’s strategy and operational capacity.

- Commission Accumulation : Affiliates earn commissions based on their performance, which includes actions like sales conversions, clicks, or leads generated through their referral links. Each affiliate’s performance is tracked meticulously, and commissions are calculated accordingly.

- Threshold Fulfillment : Once the affiliate

’s accumulated commissions reach or exceed the threshold, the affiliate becomes eligible for a payout. If the threshold is not met by the end of a payment cycle, the earnings are rolled over to the next period. This rollover mechanism ensures that affiliates do not lose their earned commissions and provides a continuous incentive to reach the threshold.

- Payout Schedule : Payments are usually processed on a predefined schedule, which could be monthly, quarterly, or at other intervals, depending on the affiliate program’s policies. The scheduling of these payouts is crucial for both affiliates and merchants, as it dictates the cash flow and financial planning for both parties.

Join our newsletter

Be the first to know about new features and product updates.

Determining the Ideal Payment Threshold

Selecting the right payment threshold is crucial for both affiliates

and merchants. Several factors influence this decision:

- Average Sale Value : Understanding the average transaction value can help in setting a realistic threshold. If the average sale is low, a lower threshold might be more appropriate to prevent affiliates from becoming discouraged.

- Affiliate Commission Rates : Higher commission rates might warrant a higher threshold since affiliates can reach it faster compared to lower commission rates.

- Market Competitiveness : In a highly competitive market, setting a lower threshold might attract more affiliates to join the program.

- Administrative Costs : The cost of processing payments can influence the threshold setting. Higher thresholds can reduce the frequency of payments, thereby lowering administrative costs.

Examples of Payment Thresholds in Affiliate Programs

Different affiliate

programs have varying payment thresholds. Here are a few examples:

- Amazon Associates Program : Known for its vast network, Amazon typically sets its payment threshold at $10 for direct deposit, $100 for checks, and $10 for Amazon gift cards. This flexibility allows affiliates to choose the most convenient method of payment.

- Google AdSense : This program requires a payment threshold of $100 before earnings are released to the affiliate. The relatively high threshold reflects Google’s strategy to manage its extensive affiliate network efficiently.

- ClickBank : Affiliates must reach a minimum of $10 for payment through direct deposit, but this can vary based on the selected payment method. ClickBank offers various methods and thresholds, giving affiliates multiple options to receive their earnings.

Impact of Payment Thresholds on Affiliate Strategy

Payment thresholds can significantly influence an affiliate

’s strategy. Here’s how:

- Motivation and Goal Setting : Affiliates may set specific targets to reach the payment threshold within a given timeframe, driving them to optimize their marketing strategies.

- Partnership Selection : Affiliates might choose to partner with programs that have lower thresholds if they prefer more frequent payouts.

- Diversification of Income : Affiliates often promote multiple products or services to ensure they meet the payment threshold in various programs, thus diversifying their income streams.

Challenges of Payment Thresholds

While payment thresholds are beneficial, they also present certain challenges:

- Complex Calculations

- Affiliates must keep track of their earnings across various programs and ensure they meet each program’s threshold, which can be complex and time-consuming.

- High Thresholds

- If set too high, a payment threshold can demotivate affiliates, especially those who are just starting or operate in niches with lower commission potential.

- Delayed Payments

- Rolling over commissions to subsequent periods can lead to delays in affiliates receiving their earnings, which might affect their cash flow.