Definition of Profit Margin

Profit margin is a crucial financial metric that measures the percentage of revenue that exceeds the costs of operating a business. Expressed as a percentage, it indicates how much profit a company makes for every dollar of sales generated. For example, a 20% profit margin means that a company retains $0.20 for every dollar of revenue earned. Understanding profit margins is essential for assessing a company’s financial health, operational efficiency, and its ability to generate profit relative to its competitors.

Profit margin serves as a key performance indicator (KPI) for businesses, investors, and analysts, helping them to evaluate the effectiveness of a company’s cost control measures and pricing strategies. It is an integral part of financial analysis and strategic planning, providing insights into how well a company is managing its resources and whether it is generating sufficient profits to sustain its operations and growth.

Types of Profit Margins

Understanding profit margins involves exploring three primary types, each offering a distinct view of a company’s profitability:

1. Gross Profit Margin

Definition: Gross profit margin assesses the proportion of revenue that exceeds the cost of goods sold (COGS). It is a measure of how well a company controls the cost of its production.

Formula:

Gross Profit Margin = (Revenue – COGS) / Revenue * 100

Example: If a company sells T-shirts at $20 each and the COGS is $10, the gross profit margin is 50%.

Application: It helps in evaluating the profitability of specific products and determining pricing strategies. A higher gross profit margin indicates that a company retains more revenue after covering the costs of production, which can be reinvested into other areas of the business like research and development, marketing, or expansion.

2. Operating Profit Margin

Definition: Operating profit margin considers the profit a company makes from its core business operations, excluding expenses related to taxes and interest.

Formula:

Operating Profit Margin = Operating Profit / Total Revenue

Operating Profi = Sales – COGS – Operating Expenses – Depreciations & Amortization

Example: A company with an operating income of $12,000 and revenue of $50,000 has an operating profit margin of 24%.

Application: This margin helps in understanding the efficiency of a company’s operations and its ability to manage operational expenses. It is particularly useful for comparing companies within the same industry as it reflects the core business operations without the influence of tax strategies or financial leverage.

3. Net Profit Margin

Definition: Net profit margin reflects the overall profitability of a company after all expenses, including operating costs, COGS, interest, and taxes, have been deducted from total revenue.

Formula:

Net Profit Margin = Net Profit ⁄ Total Revenue x 100

Example: For a company with $600,000 in revenue and a net income of $260,000, the net profit margin is 56%.

Application: It provides a comprehensive view of a company’s financial health and efficiency in converting revenue into actual profit. A higher net profit margin indicates a more profitable company that has better control over its costs and is more efficient at converting sales into actual profit.

Importance of Profit Margins in Business

Profit margins are critical for several reasons:

- Financial Health: They serve as a primary indicator of a company’s financial stability and operational efficiency. A healthy profit margin ensures that a company has enough resources to sustain operations, invest in growth opportunities, and weather economic downturns.

- Investment Decisions: Investors and lenders use profit margins to assess the profitability and growth potential of a business. High profit margins can attract investors as they suggest a lower risk of financial distress and a higher potential for future returns.

- Cost Management: By analyzing profit margins, companies can identify areas where costs can be reduced to improve profitability. It helps businesses in strategic decision-making regarding pricing, cost control, and resource allocation.

- Competitive Analysis: Profit margins allow for comparison with industry peers, although comparisons should be made within the same sector due to variability in margins across industries. Understanding how a company’s profitability compares to its competitors can provide insights into its competitive advantage and market position.

Profit Margins in Affiliate Marketing

In affiliate marketing, understanding and optimizing profit margins is essential for both affiliates and merchants. Here’s how it applies:

- Affiliates: They need to consider their cost of acquiring traffic (such as advertising costs) against the commissions earned. Affiliates aim to maximize their net profit margins by increasing conversion rates and optimizing their marketing strategies. Effective affiliate marketing requires balancing the cost of customer acquisition with the revenue generated from affiliate commissions to ensure profitability.

- Merchants: For merchants using affiliate marketing, profit margins help in determining the commission rates they can offer while remaining profitable. They must balance between attracting affiliates and maintaining healthy profit margins. By analyzing their profit margins, merchants can set competitive yet sustainable commission rates that incentivize affiliates while protecting their bottom line.

Factors Affecting Profit Margins

Several factors can affect a company’s profit margins:

- Industry Type: Different industries naturally have varying profit margins. For example, technology firms often have higher profit margins compared to retail businesses. This is due to differences in cost structures, pricing power, and competitive dynamics within each industry.

- Economic Conditions: Economic downturns can squeeze margins as costs rise and consumer spending falls. Companies may face increased pressure to lower prices, which can reduce profit margins unless offset by cost reductions or efficiency improvements.

- Operational Efficiency: Better operational practices can lead to higher margins by reducing costs and improving revenue generation. Companies that invest in technology, streamline processes, and optimize supply chains can enhance their operational efficiency and improve profit margins.

Improving Profit Margins

Businesses can improve their profit margins by:

- Reducing Costs: This includes cutting unnecessary expenses, negotiating better terms with suppliers, and optimizing operations. Cost reduction strategies should focus on areas that do not compromise product quality or customer satisfaction.

- Increasing Prices: Carefully raising prices can improve margins if the market allows without sacrificing sales volume. Companies must assess their pricing power and market conditions to determine the optimal pricing strategy that maximizes profit margins without alienating customers.

- Enhancing Product Mix: Focusing on higher-margin products or services can improve overall profitability. Companies can analyze their product portfolio to identify and promote products with higher profit margins, thereby boosting overall profitability.

- Boosting Sales Volume: Increasing the sales volume without proportionately increasing expenses can lead to better margins. Strategies to increase sales volume include expanding market reach, improving customer retention, and enhancing marketing efforts to attract new customers.

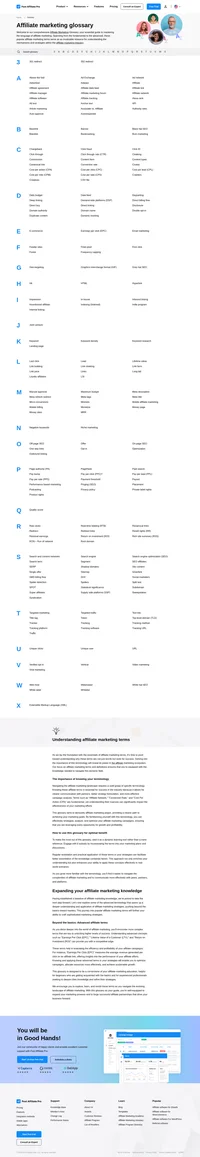

Explore Post Affiliate Pro's comprehensive Affiliate Marketing Glossary to enhance your industry knowledge with easy-to-understand definitions of essential terms. Perfect for marketers seeking to understand the fundamentals and advanced concepts, this glossary helps you master the language of affiliate marketing. Visit now to boost your expertise!