BluePay integration

The one-stop shop for all your payment processing solutions.

Integration with BluePay uses BluePay’s custom field (there are two available) and a Trans Notify Post which sends order details to a predefined URL. What you have to do is to point the URL to your BluePay plugin of your Post Affiliate Pro.

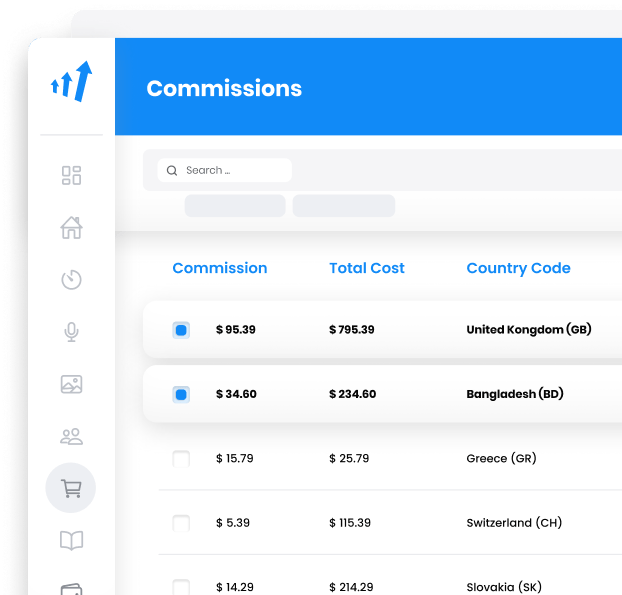

The plugin can read total cost, order ID, recurring commission and refunds, and customer information. You can also create an affiliate account for your paying customers automatically.

How to integrate PostAffiliatePro with BluePay

Plugin configuration

First of all, you have to activate the Bluepay plugin in your PAP. After the activation, you have to configure the plugin – set custom field ID 2 (custom field 1 is not supported anymore) and set if you want an affiliate account to be created when payments received.

BluePay configuration

The integration is based on Trans Notify Post function – it sends data notification about each order to a predefined URL. The URL will be the BluePay plugin of your Post Affiliate Pro. To make it working, you have to use this URL as your Trans Notify Post:

https://URL_TO_PostAffiliatePro/plugins/Bluepay/bluepay.php

HTML form

To integrate your payment forms, you only have to add a hidden field for custom values. Make sure your buttons do not include CUSTOM_ID2 in the protected fields.

Here is the hidden field tracking code:

<input type="hidden" name="CUSTOM_ID2" value="" id="pap_ab78y5t4a" />

<script id="pap_x2s6df8d" src="https://URL_TO_PostAffiliatePro/scripts/trackjs.js" type="text/javascript"></script>

<script type="text/javascript">

PostAffTracker.writeCookieToCustomField('pap_ab78y5t4a');

</script>

In case you already use CUSTOM_ID2, continue to the next step please.

This is it, you are done. Payments will be tracked to your Post Affiliate Pro from now.

HTML form – custom fields already used

If you already use both custom fields for something else, you will have to use the following code. The code will add a special separator to the existing value and then the needed tracking value (visitor ID).

In our example we are using a default “||” separator which you can change in plugin configuration and in the integration code.

The first step is to add the ID attribute to the custom field:

id=”pap_ab78y5t4a”

When added, add this code to the button form you are integrating:

<script id="pap_x2s6df8d" src="https://URL_TO_PostAffiliatePro/scripts/trackjs.js" type="text/javascript"></script>

<script type="text/javascript">

PostAffTracker.setAppendValuesToField('||');

PostAffTracker.writeCookieToCustomField('pap_ab78y5t4a');

</script>

This is the result hidden field and the tracking code below it:

<input type="hidden" name="CUSTOM_ID2" value="existing_custom_value" *id="pap_ab78y5t4a"* />

<script id="pap_x2s6df8d" src="https://URL_TO_PostAffiliatePro/scripts/trackjs.js" type="text/javascript"></script>

<script type="text/javascript">

PostAffTracker.setAppendValuesToField('||');

PostAffTracker.writeCookieToCustomField('pap_ab78y5t4a');

</script>

HTML form – custom fields already used – final step

There is one last step you have to take – as you already use custom fields for some other purposes than for Post Affiliate Pro tracking, you have to make sure the custom value we added will be removed so your application/code could work correctly.

Find the scrip which processes custom fields and add this code somewhere before your the custom values are loaded (we are using PHP code in our example, with custom ID 2):

$customSeparator = '||';

$explodedCookieValue = explode($customSeparator, $_GET['custom_id1'], 2);

if (count($explodedCookieValue) == 2) {

$_GET['custom_id2'] = $explodedCookieValue[0];

}

That’s it, your sale tracking has just been integrated.

Do not forget to integrate your site with the click tracking code.

What is BluePay?

BluePay is a leading payment processing company operating primarily in the United States and Canada. It offers a comprehensive payment gateway solution that enables businesses to securely accept a variety of payment types, including credit cards, debit cards, and ACH payments online. BluePay’s services encompass point-of-sale systems, mobile processing, virtual terminals, and voice-activated payment systems. The company provides seamless integrations with popular platforms like WordPress, Magento, and WooCommerce, making it a versatile solution for businesses looking to streamline their payment processes.

Founded in 2003 by John Rante and headquartered in Naperville, Illinois, BluePay has grown significantly over the years. In 2017, it was acquired by First Data for $760 million, highlighting its substantial impact in the payment processing industry. The expansion continued when BluePay was further acquired by NXGEN and Payscape in 2019. Throughout its history, BluePay has focused on providing efficient and secure payment solutions, earning its place in key fintech analysis collections.

BluePay targets businesses that require robust and secure payment processing solutions, particularly those handling major credit cards and ACH payments. The company tailors its services to businesses that prioritize security and efficient transaction management. With integrations available for various e-commerce and accounting platforms, BluePay is an ideal choice for businesses looking to enhance their payment systems while maintaining top-notch security.

Key Features of BluePay’s Services

- Comprehensive Payment Processing: BluePay supports credit cards, ACH transactions, and electronic invoicing, including Level 2/3 processing for enhanced transaction details.

- Advanced Security Measures: With PCI compliance, encryption, tokenization, and fraud prevention tools, BluePay ensures that transactions are secure and customer data is protected.

- Recurring Billing and Invoicing: Businesses can take advantage of electronic invoicing and set up recurring billing options, simplifying payment collection from customers.

- Integration Capabilities: BluePay offers compatibility with QuickBooks, various e-commerce platforms, and POS systems, allowing businesses to integrate payment processing seamlessly into their existing workflows.

- Custom Reporting Tools: Real-time sales channel reporting provides businesses with valuable insights into their performance and customer behavior.

- Dedicated Customer Support: BluePay provides assistance via phone and email, along with training resources to help businesses maximize the benefits of their payment solutions.

BluePay’s Pricing Structure

- Tiered Pricing Model: BluePay employs a tiered pricing system, though some associated fees may not be immediately transparent.

- No Setup Fees: While there are no setup fees, businesses are subject to a $99 annual fee and a monthly fee of $12.99.

- Early Termination Fee: A $295 early termination fee applies for three-year contracts, which can be a significant consideration for some businesses.

- Transaction Fees: Standard transaction fees are 2.29% plus $0.29 per transaction, with American Express transactions at 2.89%.

Businesses considering BluePay should carefully review the terms to fully understand all fees and contractual obligations.

User Insights on BluePay

- Pros:

- Strong Security Measures: BluePay’s emphasis on security provides peace of mind for businesses and their customers.

- Versatile Processing Options: Offers various processing solutions, including mobile and e-commerce capabilities.

- Integration with QuickBooks: Simplifies accounting processes by integrating payment data directly into financial software.

- Cons:

- Opaque Pricing: Some users report that fees are not clearly disclosed, leading to unexpected costs.

- Hidden Fees: Reports of undisclosed fees can be a drawback for businesses trying to manage expenses.

- Long-Term Contracts: The requirement for long-term contracts with significant cancellation fees may not suit all businesses.

- Overall Experience: While many find BluePay reliable, especially for long-term contractual relationships, there is criticism regarding pricing transparency and contract terms. Businesses should conduct thorough due diligence before committing.

BluePay in the Media

- BluePay Review 2023: An in-depth review covering features, benefits, and the latest updates to BluePay’s services.

- BluePay vs EBizCharge – Direct Comparison: A comprehensive overview that compares BluePay with other payment gateways.

- Using BluePay for Business Transactions: Demonstrations of setup processes and user experience insights.

These resources provide valuable perspectives for businesses considering BluePay as their payment processing solution.

Alternatives to BluePay

For businesses exploring other options, several alternatives to BluePay offer similar services:

- Square – Square Website

- Paysafe – Paysafe Website

- TSYS – TSYS Website

- Braintree – Braintree Website

- Paymentwall – Paymentwall Website

- Takepayments – Takepayments Website

- Quantum Electronic Payments – Quantum Website

- Tide – Tide Website

- Clearly Payments – Clearly Payments Website

- PangoPay – PangoPay Website

The leader in Affiliate software

Post Affiliate Pro offers a comprehensive affiliate software platform to manage multiple affiliate programs with ease. Enjoy no setup fees, 24/7 customer support, and a free 1-month trial. Ideal for small and large businesses, it features precise tracking, automated workflows, and customizable tools to boost your affiliate marketing success. Try it now and streamline your affiliate operations effortlessly!

Effortlessly integrate your e-commerce site with Post Affiliate Pro and boost your affiliate program's success. Our expert team ensures seamless integration with your payment processor, handling technical issues along the way. Enjoy a free trial and free integration service, saving you time and maximizing your ROI. Join now and experience top-notch affiliate management with over 500 integration options.

Explore seamless integrations with Post Affiliate Pro to enhance your affiliate marketing strategies. Discover solutions for e-commerce, email marketing, payments, and more, with easy integrations for platforms like 1&1 E-Shop, 2Checkout, Abicart, and many others. Optimize your affiliate network with these powerful tools.