WorldPay integration

A leading global payments provider for companies of all sizes.

How to integrate PostAffiliatePro with WorldPay

WorldPay integration is similar to PayPal, it also uses WorldPay callback.

Note! This is description of integration with WorldPay if you useWorldPay buttons on your web pages. If you use WorldPay as a processingsystem in your shopping cart, use the method for integrating withshopping cart, not these steps.

Also, make sure you don’t alreadyuse WorldPay callback for another purpose, such as some kind of digitaldelivery or membership registration.

Since version 4.2.5.0 integration with WorldPay works also with FuturePay recurring commissions.

Add code

Now add the following code into EVERY WorldPay button form:

<input type="hidden" name="M_aid" value="" id="pap_dx8vc2s5">

<script id="pap_x2s6df8d" src="https://URL_TO_PostAffiliatePro/scripts/notifysale.php" type="text/javascript">

</script>

This will assign cookie value into M_aid and this value will be sent to PAP for processing.

Example

Example of updated WorldPay form:

<form action="http://www.worldpay.com....>

...

<input type="hidden" name="M_aid" value="" id="pap_dx8vc2s5">

<script id="pap_x2s6df8d" src="https://URL_TO_PostAffiliatePro/scripts/notifysale.php" type="text/javascript">

</script>

...

</form>

Configuration

Next step is to configure WorldPay to use callback to our worldpayscript. You should specify there full url to the worldpay script:

https://URL_TO_PostAffiliatePro/plugins/WorldPay/worldpay.php

Now activate plugin “WorldPay callback handling” and that’s it. This is all that is required. Now whenever there’s sale, WorldPay willuse its callback function to call our sale tracking script, and systemwill generate commission for the affiliate.

What is WorldPay?

WorldPay is a comprehensive payment processing solution designed to facilitate secure and efficient transactions for businesses of all sizes. Offering a wide array of features, WorldPay supports credit and debit card payments, recurring billing, ACH payments, eCheck processing, and provides end-to-end encryption to ensure the security of cardholder data.

WorldPay’s history dates back to 1971 when it was established as Midwest Payment Systems under Fifth Third Bank. Over the years, it evolved into Vantiv in 2011 and went public in 2012. A significant milestone occurred in 2017 when Vantiv acquired WorldPay, leading to the formation of WorldPay, Inc. In 2019, WorldPay merged with FIS in one of the industry’s largest consolidations. By 2024, WorldPay was spun off from FIS and acquired by GTCR, reestablishing itself as an independent entity.

WorldPay primarily caters to multichannel retailers and small business merchants. Its target market includes large internet-led multinational firms, U.S.-based merchants focusing on small to medium-sized businesses, and U.K. merchants ranging from micro to large corporations. By offering diverse payment solutions across multiple channels, WorldPay enhances business capabilities and supports growth.

Key Features of WorldPay

WorldPay offers a robust set of features designed to meet the diverse needs of businesses:

- Card Payments API: Facilitates seamless payment processing with real-time account updater requests.

- Payments API: Supports various payment plans and recurring subscriptions, making it ideal for businesses with subscription models.

- Checkout SDK: Provides a secure checkout experience with PCI-SSF certification, ensuring secure sessions for customers.

- Fraud Protection Tools: Includes FraudSight and Exemptions API to enhance fraud protection and reduce chargebacks.

- Global Payment Methods: Supports multiple alternative payment methods worldwide, allowing businesses to cater to an international customer base.

- Developer Tools: Offers comprehensive tools for developers to enable seamless integration with existing systems.

Pricing Structure of WorldPay

WorldPay’s pricing includes various transaction fees and additional charges:

- In-Person Transactions: 2.6% + $0.10 per transaction.

- Online Transactions: 2.9% + $0.30 per transaction.

- Manually Keyed Transactions: 3.5% + $0.15 per transaction.

- Additional Fees: Charges for compliance, transaction risk fees (TRF), authorization, and batch processes may apply.

User Insights on WorldPay

Users of WorldPay have provided mixed feedback based on their experiences:

- Pros:

- Diverse Offerings: Wide range of payment solutions accommodating various business needs.

- Excellent Customer Support: Responsive support team assisting with issues and inquiries.

- Robust Integrations: Seamless integration capabilities with other systems and platforms.

- Cons:

- High Costs: Higher transaction fees compared to some competitors.

- Hidden Fees: Additional charges not always transparent upfront.

- Longer Contract Terms: Commitment to lengthy contracts may not suit all businesses.

While users appreciate the comprehensive services provided by WorldPay, concerns about the pricing structure and lack of transparency have been highlighted.

WorldPay Reviews on YouTube

For more in-depth analysis and reviews of WorldPay, consider watching the following YouTube videos:

- WorldPay Review 2023

- Comprehensive WorldPay Review for Businesses 2023

- Pros and Cons of WorldPay in 2023

Alternatives to WorldPay

Businesses exploring other payment processing options may consider the following alternatives:

- Stripe: Stripe

- PayPal: PayPal

- Square: Square

- Adyen: Adyen

- Authorize.net: Authorize.net

- Checkout.com: Checkout.com

- Elavon: Elavon

- PaySimple: PaySimple

- Flywire: Flywire

- Wise Business: Wise Business

WorldPay is a robust solution for business

Effortlessly integrate your e-commerce site with Post Affiliate Pro and boost your affiliate program's success. Our expert team ensures seamless integration with your payment processor, handling technical issues along the way. Enjoy a free trial and free integration service, saving you time and maximizing your ROI. Join now and experience top-notch affiliate management with over 500 integration options.

Integrate GoPay with Post Affiliate Pro to effortlessly register sale commissions using the API. Learn how to set the SuccessURL parameter, send special data, and ensure smooth commission registration. Enhance your affiliate marketing with a tailored dashboard and explore its benefits by scheduling a call with us today!

Integrate Segpay with Post Affiliate Pro to effortlessly track recurring payments and refunds. Follow our simple setup guide to enhance your digital payment processing and reduce fraud risk. Transform your business with our trusted, user-friendly affiliate marketing software featuring 24/7 support. Start your free trial today!

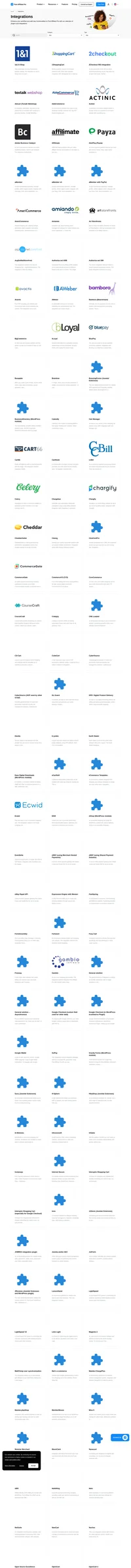

Explore seamless integrations with Post Affiliate Pro to enhance your affiliate marketing strategies. Discover solutions for e-commerce, email marketing, payments, and more, with easy integrations for platforms like 1&1 E-Shop, 2Checkout, Abicart, and many others. Optimize your affiliate network with these powerful tools.