PaySimple integration

A leading provider of small business merchant accounts, mobile payments, electronic payments, and ACH processing services.

The integration with PaySimple is a bit tricky as they do not allow you to add any custom code to their “thank you” page, but there is an option to add a button to take customer to a custom URL, which we use in this integration.

How to integrate PostAffiliatePro with PaySimple

To start with the integration, login to your PaySimple admin account and navigate to Account Settings > Settings > Web payment pages. Here you can create or edit an existing payment form.

The tricky part begins here. There is a label field for your return URL and a field for the URL itself. You have to name it the way users really click it, e.g. “CLICK HERE TO FINALIZE YOUR ORDER” or something like that. If they do not click it, it won’t be tracked unfortunately.

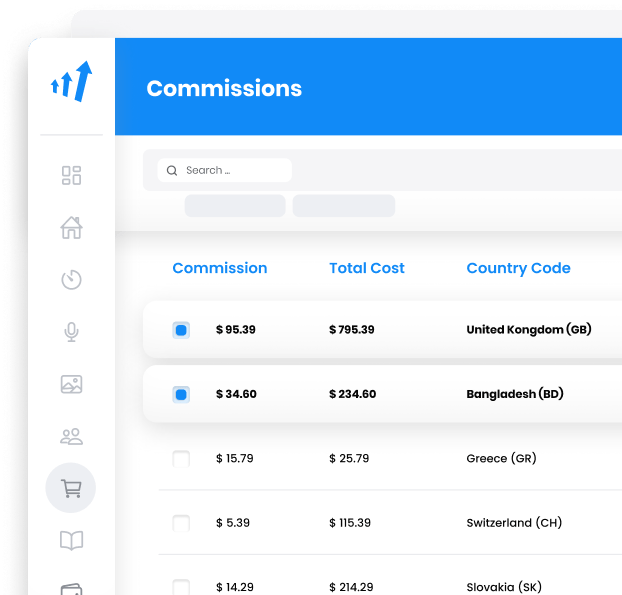

The return page URL should be a unique URL with hardcoded sale tracking code, with all params like total cost, product ID etc..

You can also set the URL to be one general URL with GET params specifying the product of this form, e.g.:

http://yoursite.com/orders/thanks.php?total=100&product=bicycle200 … depending on which form you are modifying.

Do not forget to integrate your site with the click tracking code.

What is PaySimple?

PaySimple is a cloud-based service commerce platform designed specifically for service-oriented businesses. It simplifies payment processing by providing tools to accept payments, manage customer relationships, and automate billing processes. Targeting primarily small and medium-sized enterprises, PaySimple enhances payment capabilities and operational efficiencies across various sectors.

Founded in 2006 in Denver, Colorado, PaySimple has established itself as a reliable solution for businesses aiming to optimize billing and payment processes. Over the years, it has expanded its offerings beyond basic payment processing to include features like payment scheduling, automated invoicing, and integrated customer relationship management. This evolution reflects PaySimple’s commitment to addressing the evolving needs of service-based businesses.

PaySimple targets small to medium-sized service businesses, including those in healthcare, wellness, and home services. By focusing on this segment, PaySimple dedicates its resources to enhancing cash flow, reducing administrative burdens, and improving the payment experience for both businesses and their customers. Its tools are designed to streamline operations, allowing businesses to focus more on delivering quality services.

Main Features of PaySimple

- Payment Processing with PaySimple: Accepts a variety of payment methods, including credit cards, ACH transfers, and eChecks, providing flexibility to customers and ensuring timely payments.

- Automated Billing through PaySimple: Offers recurring billing and invoicing capabilities, automating payment collection and reducing manual effort.

- Customer Management in PaySimple: Integrates CRM features to enhance customer service, track interactions, and maintain detailed records within the platform.

- Mobile and Online Payments with PaySimple: Provides customers the convenience of making payments anytime, anywhere, via mobile devices or online portals.

- Analytics Provided by PaySimple: Delivers insights into transactions and customer data, helping businesses make informed decisions and identify growth opportunities.

PaySimple Pricing Options

- Monthly Platform Fees: Starting at $29.95 for basic services, including essential payment processing tools, and $89.95 for advanced features with additional functionalities.

- Transaction Fees with PaySimple: Charges 2.54% plus $0.35 per credit card transaction, offering transparent and competitive pricing.

- Custom Plans from PaySimple: Available for high-volume processors with specific needs, providing tailored solutions to suit unique business requirements.

Key User Insights on PaySimple

- Pros of Using PaySimple: Users appreciate its ease of use, comprehensive payment solutions, and responsive customer support. The integration of payment processing with customer management tools is seen as a significant advantage.

- Cons of PaySimple: Some users report issues with fee transparency and account management, indicating areas where PaySimple could improve.

- Overall User Experience: Many find that PaySimple effectively reduces administrative tasks and enhances cash flow, contributing positively to business operations.

PaySimple Reviews and Demonstrations

- PaySimple Payment Processing Software Review 2023

An overview of PaySimple’s services and features, highlighting its impact on businesses.

Watch on YouTube

Alternatives to PaySimple

- Square: A versatile payment processing platform suitable for various business types.

Visit Square - Stripe: A developer-friendly payment infrastructure supporting online transactions.

Visit Stripe - FreshBooks: Accounting software with invoicing and payment solutions.

Visit FreshBooks - QuickBooks Payments: Integrated payment processing within QuickBooks’ accounting ecosystem.

Visit QuickBooks Payments - Wave: Offers free accounting and invoicing with pay-per-use payment processing.

Visit Wave - Authorize.Net: Provides secure payment gateway services for businesses.

Visit Authorize.Net

Explore seamless integrations with Post Affiliate Pro to enhance your affiliate marketing strategies. Discover solutions for e-commerce, email marketing, payments, and more, with easy integrations for platforms like 1&1 E-Shop, 2Checkout, Abicart, and many others. Optimize your affiliate network with these powerful tools.

Effortlessly integrate your e-commerce site with Post Affiliate Pro and boost your affiliate program's success. Our expert team ensures seamless integration with your payment processor, handling technical issues along the way. Enjoy a free trial and free integration service, saving you time and maximizing your ROI. Join now and experience top-notch affiliate management with over 500 integration options.