Skrill (former MoneyBookers) integration

An e-commerce business that allows payments and money transfers to be made through the Internet.

How to integrate PostAffiliatePro with Skrill

Integration with Skrill (former MoneyBookers).

Activate the “MoneyBookers integration plugin”

First you have to activate the MoneyBookers integration plugin inside the merchant panel of Post Affiliate Pro (Network) in the ‘plugins‘ section.

Skrill (MoneyBookers) configuration

- Log into your Skrill (MoneyBookers) account

- Go to My Account > Merchant Tools and set a Secret Word

- Go back to the merchant panel of Post Affiliate Pro (network) to the ‘plugins‘ section, click Configure next to the MoneyBookers integration plugin plugin and enter the Secret Word into the corresponding field.

Creating Buy buttons

Edit your Skrill (MoneyBookers) button by adding these lines to it:

<input type="hidden" name="status_url" value="https://URL_TO_PostAffiliatePro/plugins/MoneyBookers/moneybookers.php">

<input type="hidden" name="merchant_fields" value="field1">

<input type="hidden" name="field1" value="" id="pap_dx8vc2s5">

<script id="pap_x2s6df8d" src="https://URL_TO_PostAffiliatePro/scripts/notifysale.php" type="text/javascript">

</script>

In case your ‘status_url‘ param is already used for something else, please do not change it and follow the step 5.

If you already use field1 too, set it to field2 (and so on…). In that case make sure your plugin (from step 2.) is configured to work with that field.

An example button

After adding the extra code, you button code might look like this:

<form action="https://www.skrill.com/app/payment.pl" target="_blank">

<input type="hidden" name="pay_to_email" value="your_moneybookers@email.com">

<input type="hidden" name="return_url_target" value="1">

<input type="hidden" name="cancel_url_target" value="1">

<input type="hidden" name="confirmation_note" value="Confirmed!">

<input type="hidden" name="dynamic_descriptor" value="Descriptor">

<input type="hidden" name="language" value="EN">

<input type="hidden" name="title" value="Mr">

<input type="hidden" name="firstname" value="John">

<input type="hidden" name="lastname" value="Payer">

<input type="hidden" name="address" value="11 Payerstr St">

<input type="hidden" name="address2" value="Payertown">

<input type="hidden" name="phone_number" value="0207123456">

<input type="hidden" name="postal_code" value="EC45MQ">

<input type="hidden" name="city" value="Payertown">

<input type="hidden" name="state" value="Central London">

<input type="hidden" name="country" value="GBR">

<input type="hidden" name="amount" value="0.01">

<input type="hidden" name="currency" value="EUR">

<input type="hidden" name="amount2_description" value="Product Price:">

<input type="hidden" name="amount2" value="0.01">

<input type="hidden" name="amount3_description" value="Handling Fees:">

<input type="hidden" name="amount3" value="0.01">

<input type="hidden" name="amount4_description" value="VAT (20%):">

<input type="hidden" name="amount4" value="0.01">

<input type="hidden" name="detail1_description" value="Product ID:">

<input type="hidden" name="detail1_text" value="4509334">

<input type="hidden" name="detail2_description" value="Description:">

<input type="hidden" name="detail2_text" value="Romeo and Juliet (W. Shakespeare)">

<input type="hidden" name="detail3_description" value="Seller ID:">

<input type="hidden" name="detail3_text" value="123456">

<input type="hidden" name="detail4_description" value="Special Conditions:">

<input type="hidden" name="detail4_text" value="5-6 days for delivery">

<input type="hidden" name="rec_period" value="1">

<input type="hidden" name="rec_grace_period" value="1">

<input type="hidden" name="rec_cycle" value="day">

<input type="hidden" name="ondemand_max_currency" value="EUR">

<input type="submit" name="Pay" value="Pay">

<!-- Post Affiliate Pro integration snippet -->

<input type="hidden" name="status_url" value="https://URL_TO_PostAffiliatePro/plugins/MoneyBookers/moneybookers.php">

<input type="hidden" name="merchant_fields" value="field1">

<input type="hidden" name="field1" value="" id="pap_dx8vc2s5">

<script id="pap_x2s6df8d" src="https://URL_TO_PostAffiliatePro/scripts/notifysale.php" type="text/javascript">

</script>

<!-- /Post Affiliate Pro integration snippet -->

</form>

When status URL param is used

In case your ‘status_url‘ param is already used for something, you only have to set the merchant field. Do not change ‘status_url‘. Save your changes in the button, and then edit the script which is set in ‘status_url‘ right now. At the beginning of the file, or processing function, place this code:

/* Post Affiliate Pro integration snippet */

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL, "https://URL_TO_PostAffiliatePro/plugins/MoneyBookers/moneybookers.php");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS, $_POST);

curl_exec($ch);

/* /Post Affiliate Pro integration snippet */

That’s it. Save your work. You are now integrated.

What is Skrill?

Skrill is a digital wallet service that enables users to make fast and secure online payments and money transfers. Founded in 2001 and headquartered in London, Skrill has become a global platform facilitating transactions across various sectors, including online betting, trading, shopping, and gaming. With its user-friendly interface and robust security measures, Skrill allows individuals and businesses to send and receive money worldwide with ease.

Originally established as Moneybookers in 2001, Skrill quickly gained recognition as a leading European online payment solution by 2007. In 2013, after changing ownership to Investcorp and CVC Capital Partners, the company rebranded to Skrill. The significant milestone in its journey was in 2015 when Optimal Payments (later known as Paysafe Group) acquired Skrill for €1.1 billion. Since then, Skrill has expanded its services extensively, including launching a cryptocurrency trading platform and introducing the Skrill Knect loyalty program.

Skrill primarily targets individuals and businesses seeking secure and convenient payment solutions on a global scale. Its focus regions include Europe, Latin America (LATAM), Asia-Pacific (APAC), Africa, and the Middle East and North Africa (MENA). Skrill caters to tech-savvy users, eCommerce businesses, and cryptocurrency enthusiasts who require fast and reliable transaction services.

Key Features of Skrill

- Online Payments: Securely pay for goods and services online across thousands of merchants.

- Send Money: Transfer funds globally to other Skrill users or directly to bank accounts.

- Skrill Prepaid Mastercard: Access funds instantly with a prepaid card usable wherever Mastercard is accepted.

- Instant International Transfers: Send money abroad with minimal delays and competitive exchange rates.

- Loyalty Programs: Earn points through the Skrill Knect program for transactions made, redeemable for rewards.

- High-Security Standards: Benefit from advanced security measures, including two-factor authentication and encryption.

- Global Reach: Operate in multiple currencies and countries, facilitating international commerce.

- 24/7 Support: Access customer service at any time for assistance with transactions and account management.

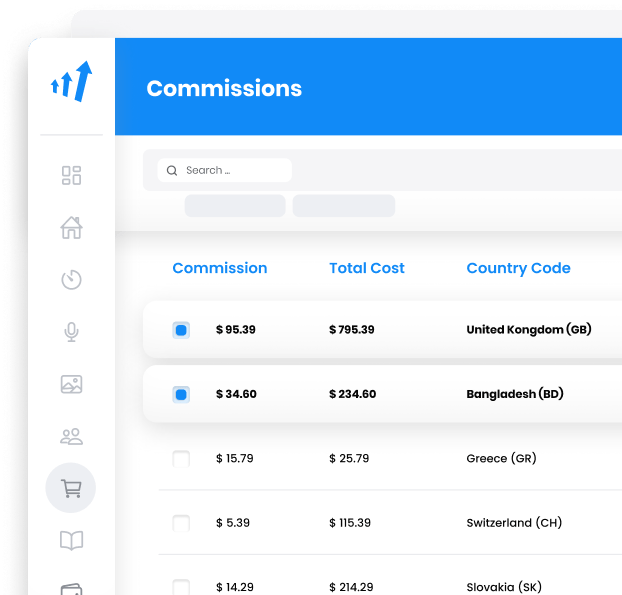

Skrill Pricing Options

Skrill offers a variety of pricing structures to accommodate different user needs:

- Free Transactions: Paying merchants directly or receiving money typically incurs no fees.

- Deposit and Withdrawal Fees: Charges vary depending on the method chosen (e.g., bank transfer, credit card, or other payment methods).

- Skrill Money Transfer: Sending money to international bank accounts is free of charge.

- Inactivity Fee: A service fee of $5.00 applies if the account remains inactive for six months.

It’s essential for users to review the specific fees associated with their transactions, as costs may vary based on currency exchanges and payment methods.

User Insights on Skrill

Pros:

- Low Transaction Fees: Competitive rates for sending and receiving money internationally.

- Reliability: Generally dependable for swift money transfers.

- Responsive Support (When Operational): Effective customer service when transactions proceed without issues.

Cons:

- Account Restrictions: Some users report unexpected limitations placed on their accounts.

- Verification Issues: Challenges with the account verification process can lead to delays.

- Customer Service Concerns: Difficulties in resolving issues promptly when problems arise.

Overall, user experiences with Skrill are mixed. While many appreciate the platform’s efficiency for straightforward transactions, others have encountered obstacles requiring support intervention.

Skrill Reviews on YouTube

- Skrill Review 2023 – Is Skrill still worth it?: This review delves into the advantages and disadvantages of using Skrill, providing an updated perspective on its services in 2023.

- Skrill vs PayPal 2023: Which one should you use?: A comparative analysis highlighting the features, fees, and usability between Skrill and PayPal, assisting users in choosing the platform that best suits their needs.

- Skrill Customer Review 2023: Honest opinions: Users share their personal experiences with Skrill, discussing both positive aspects and areas of dissatisfaction.

These reviews offer valuable insights into Skrill’s performance and user satisfaction in the current market.

Alternatives to Skrill

For those exploring other options, several platforms offer similar services:

- Wise: Specializes in international money transfers with transparent fees.

- Payoneer: Provides global payment solutions for businesses and professionals.

- Stripe: Focuses on online payment processing for internet businesses.

- PayPal Payments Pro: Offers comprehensive payment solutions with advanced features.

- Square Payments: Delivers payment processing for businesses of all sizes.

- Apple Pay: Facilitates secure payments through Apple devices.

- Authorize.net: Provides payment gateway services for merchants.

- Google Pay: Enables simple and secure payments across Google platforms.

- Checkout.com: Offers unified payment processing solutions globally.

- Adyen: Integrates payments across online, mobile, and in-store channels

Explore seamless integrations with Post Affiliate Pro to enhance your affiliate marketing strategies. Discover solutions for e-commerce, email marketing, payments, and more, with easy integrations for platforms like 1&1 E-Shop, 2Checkout, Abicart, and many others. Optimize your affiliate network with these powerful tools.

Effortlessly integrate your e-commerce site with Post Affiliate Pro and boost your affiliate program's success. Our expert team ensures seamless integration with your payment processor, handling technical issues along the way. Enjoy a free trial and free integration service, saving you time and maximizing your ROI. Join now and experience top-notch affiliate management with over 500 integration options.

The 9 Best payment processors for affiliate marketing

Discover the 9 best payment processors for affiliate marketing that ensure secure, flexible, and rapid commission payments. Boost your eCommerce sales by selecting a reliable processor to attract top affiliates and enhance your program. Explore our comprehensive guide to choosing the right payment processor for your affiliate marketing success.